“Comment is free, but facts are sacred.”— CP Scott

Given my bone fide role as a footnote in the history of Bitcoin, people often ask me what I think about cryptocurrencies (a.k.a. “crypto”).

They’re especially interested in what I think will happen in the near future. Because that’s all people really care about with crypto.

But I don’t know anything. In fact, it’s likely I know even less than they do.

All I have are my personal opinions.

And if you’re interested in these then, great news, they’re free of charge. Keep reading.

1. Crypto is not an actual currency. So, you are not “Forex trading”.

I really hope this one is obvious. But maybe not.

Actual world currencies have a number of identifiable traits:

- You can spend a currency in the majority of shops. Not just a handful of progressive retailers in the weirder parts of the internet. Yes, I know about El Salvador. That would be better news if the International Monetary Fund (IMF) weren’t asking them to reverse the decision.

- Regulators around the world aren’t advising you steer clear of it.

Perhaps the most useful test? With real world currency, you can give some to your grandma and she will know what to do with it.

This is not saying anything bad against grandmas. I’m sure some of them are very switched on about crypto.

Most aren’t.

- So, future prediction #1: If they are indeed to be a currency, cryptos have a long way to go in some important areas. They have shown no real sign of getting there over recent years. And they probably can’t in their current forms because they aren’t genuinely designed or intended to do so.

2. Bitcoin transfers wealth from poor people, to rich people.

There’s an old saying that you shouldn’t invest money unless you can afford to lose it.

In other words, investments need to be from money that’s…

- outside of your (comfortable) living expenses

- outside of your rainy day fund

- outside your pension contributions

- … and so on.

Most ordinary people don’t have this money. So, I believe many poorer people are investing money in Bitcoin when they can’t really spare it. They dip into their rainy day savings, for example. They may even borrow money, and the historically low interest rates recently are enabling this.

43% of men in the US aged 18 to 29 have invested in crypto. This is not an age group running around with spare cash. Far from it.

Crypto “investors” hope for big returns in the short-term. Nobody is into crypto for returns in five, 10 or 15 years. That’s laughable.

True, many have achieved stunning short-term returns. But there’s a name for situations where you hope for instant or short-term returns.

We call it gambling.

And that’s fine, if know you’re gambling and not investing.

Gambling is addictive. It’s often damaging to people, families and communities. People who win in casinos don’t then walk out into the cool night air. They “reinvest” their winnings in the hope of a bigger win.

People are no more “investing” in Bitcoin than they would be investing in a white ball circling a spinning wheel.

What is investing, then? Well, investing as ordinary people experience it typically has the following identifying markers:

- Long-term return on investments.

- Often it contributes to a business to aid its growth – and you are implicitly interested in that growth because of your investment.

- It’s backed by research and data. This is possible because the performance is, to a degree, predictable. Stocks and shares are not random. The ability to track and predict their performance is a rare skill, but business empires have been built on it.

1 in 3 people who invest in crypto don’t have a clue about how it works.

Meanwhile, at the other end, rich corporates and financial institutions are increasingly starting to hold cryptocurrencies like Bitcoin. Of course they are. Their job is to make money out of the rest of us. They sniff out people throwing money around, just like sharks are attracted to blood in the water. And they’re just as ruthless.

Think about it. You’re a wealthy arsehole, of the type residing in the murkier lagoons of corporate banking. You want an investment device to legitimately extract money from regular people as efficiently as possible.

What would be on your list of features?

- You want it to be unregulated. This way none of those pesky governments can step in to protect small investors, like they often do. So annoying!

- You want people to have big wins initially so that it generates headline news. If this happens then more idiots will pile in because they fear missing out.

- You want it to seem fundamentally simple. Computers generate Bitcoins, somehow. People buy them. They increase in value, somehow. You do not want any of that scary or time-consuming stuff like research and knowledge that makes investing in stocks and shares so difficult!

- You want it to be ultra-accessible. Totally online, for example. No real world nonsense like signing forms or dealing with banks. Make it so a guy can do it without his family even being aware!

- You want it to look like an actual investment so that if people lose money then, well, that’s because they’re stupid. It’s not because they got unlucky, or are involved in something far beyond their understanding or control.

Cryptocurrency promised to overhaul capitalism.

All that’s happened is that—surprise, surprise—it’s strengthened the same old winners within the capitalist system.

The poor continue to be exploited. The rich continue to get richer. It’s just made the whole shebang a lot more efficient.

Which side of the divide are you on?

- Prediction #2: Bitcoin will increasingly pass money from poor people to rich people. And the poor people will believe it’s their fault. Like buying lottery tickets, small-scale speculation investments in crypto have all the signs of being a tax on stupid people.

3. Bitcoin is environmentally disastrous.

Bitcoin is the direct conversion of electricity into monetary value.

Increasingly difficult computational tasks create Bitcoin. This is baked into Bitcoin’s DNA, and so Bitcoin generation will always require more and more energy.

Today, Bitcoin “mining” (that is, this creation of Bitcoin out of thin air) consumes more energy than several western countries.

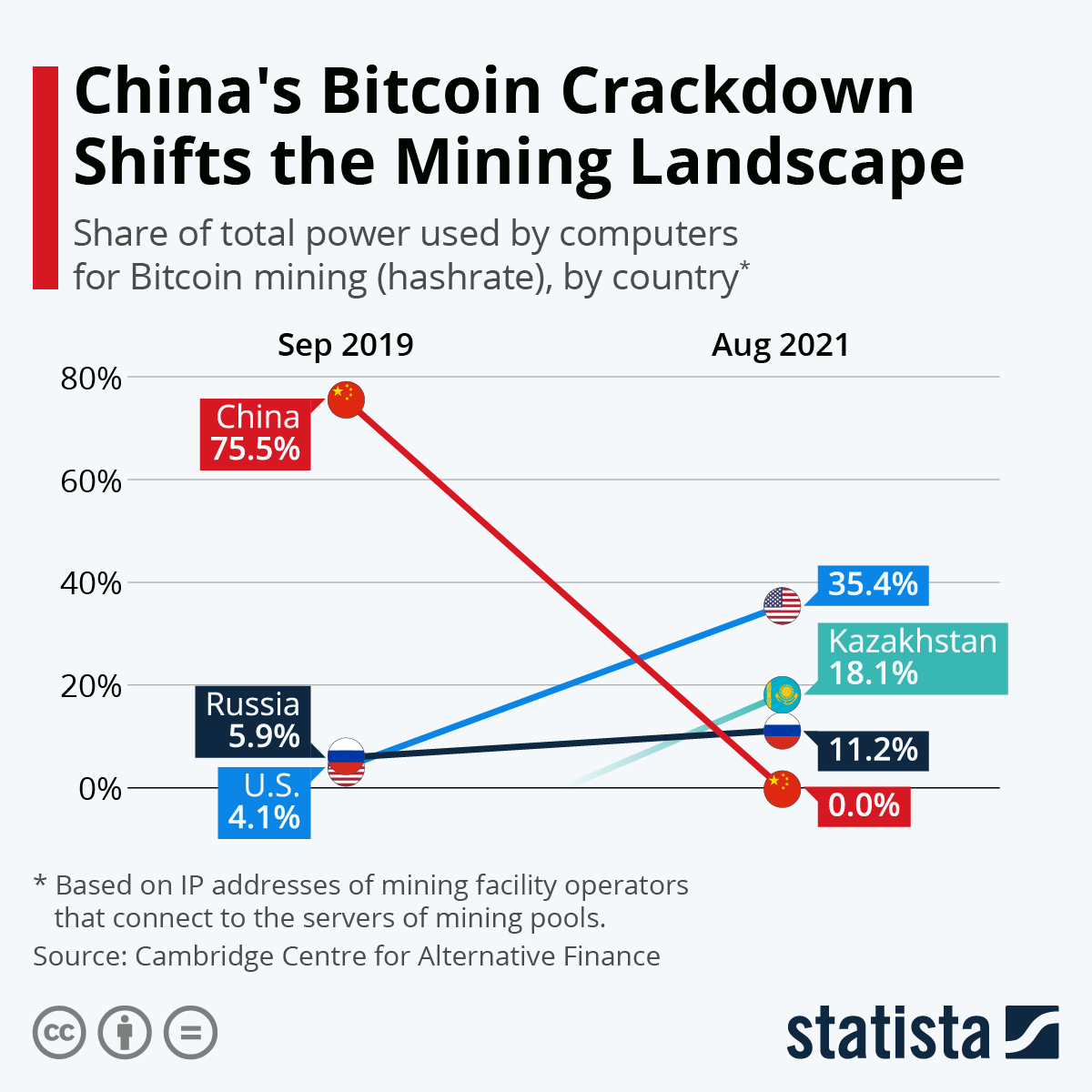

35.4% of all the energy powering computers in the US goes into generating Bitcoin.

This comes at the exact moment when global energy reserves are precious and prices are going insane (here in the UK, where I live, the annual household fuel bill is set to double).

Oh yeah, and there’s also the whole environmental crisis thing, for which energy production is a significant contributing factor.

Should I ever interview “Satoshi Nakamoto”, this is the first question I would put to him:

Did you consider the sheer amount of electricity draw that Bitcoin mining would require? And given that green energy wasn’t much of a thing when you wrote your Bitcoin white paper, and green energy is still in its infancy even now (2022), did you realise the environmental damage your invention would bring?

Let’s be clear. We’re not talking about the future here. The rampant energy consumption is happening right now. Crypto generation is gobbling up the world’s finite energy reserves at the exact moment they can’t be spared.

“Satoshi Nakamoto” needs to take responsibility. I genuinely wonder if this is why he hasn’t shown his face.

- Prediction #3: Crypto will increasingly consume our precious energy around the world, drive prices higher and create more environmental devastation. This is a legitimate angle for governments to regulate crypto, without needing to introduce any discussion around centralising regulation or control.

4. Bitcoin is perfect for laundering money.

If you’re a dodgy individual, with dodgy money, then you need to convert that money into legitimate money.

And you want to be able to move it across national borders, without anybody knowing.

Across 2021, research suggests that $8.6bn was laundered by criminals using crypto. This is an increase of 30% compared to 2020, but still lower than the record high $10.9bn in 2019.

Got a load of cash from fraudulent phone banking scams? You know the kind I mean—the kind of scam that rips off grandmas and grandpas to the tune of tens if not hundreds of thousands of dollars/pounds/Euros.

Quick! Get it out of that bank account before somebody notices. Make it so that if you get caught, the money is out of reach.

Once again, Bitcoin might as well be custom-designed for this task.

Ransomware, malware, human traffickers, dark net sellers of addictive opiates and weapons, terrorist groups… They all just love crypto, according to the same research as mentioned earlier.

OK, so criminals do criminal things. Big deal. Don’t blame crypto for that!

But if you invest in Bitcoin then you’re enabling and empowering these people.

Criminals also use US dollars, or Euros, and so on. But that monetary system exists independently of them, and us. It’s created and backed by governments. If we all stopped using it then it wouldn’t go anywhere.

I’m not going to go into the whole fiat currency issue. But if we all stopped buying and selling Bitcoin tomorrow then it would die instantly. It came from literally nothing, and it would return to nothing.

Crypto exists only because we buy and sell it, and we do that because we hope to make money.

Crypto is the digital manifestation of human greed.

Is there a moral angle to wealth generation? Yes, I believe there is. And I’m not alone. In a world where environmental, social and governance (ESG) policies are being enacted in most corporate environments, this matters more than ever.

- Prediction #4: Criminality is one of the biggest risks to crypto. If they decide it isn’t worth it any longer, or a better way of money laundering comes along, they can kill its value. On the other hand, increased criminal investment in crypto again provides an angle for government regulation outside of an attempt to centralise control.

What’s the future of Bitcoin?

I’ve no idea. Nobody does. That is a huge warning sign.

Bitcoin and crypto generally has the characteristics of an investment bubble. But that bubble is seemingly made out of glass. It’s not for bursting despite many blow darts being fired at it.

But it could shatter if everybody drops it.

For most people, I suspect it’s turned into a waiting game until this drop occurs. A test of nerves.

That is not an entirely legitimate way to be making money.

And when it happens, don’t try and say the warnings signs were not everywhere you looked:

- Warning sign #1: Spam messages suggesting you invest in crypto. Of all the people in the world who you might take advice from, spammers are at the absolute bottom of the pile.

- Warning sign #2: There are so many fake crypto schemes that there are even names for the individual types of scam. Have you been the victim of a rug pull?

- Warning sign #3: Large institutional investors. With their huge investments, they can become the market. They can make it go up. They can make it go down. Nobody can stop them. It’s not regulated. All you can do is watch.

- Warning sign #4: Celebrity endorsements. It all feels a little… MLM?

- Warning sign #5: Increasing government prohibitions and regulations.

- Warning sign #6: Precipitous drops in value.

- Warning sign #7: Sharp rises in value, for no genuinely discernible reason (other than, you know, that greed mentioned earlier).

- Warning sign #8: The fact you’re reading this and thinking, “He’s just rehashing the same old criticisms.”

On the wider issue of crypto generally, the central problem is that crypto cannot be responsible from an ESG perspective. It’s environmentally unfriendly. It enables criminality.

This is unacceptable in a civilised society. Can it be changed?

Not with existing implementations.

The value in the story of Bitcoin, as seen in hindsight, when all the rich people have checked out after becoming even richer, will be as a proof of concept.

It worked.

Can it be done better? Crypto needs to be implemented with checks and balances built in. These needn’t be defined by a central regulator. They can be implemented algorithmically.

This would be the true beauty of a crypto system that’s built to last.

Wherever Satoshi Nakamoto, I really do hope he’s applying his intelligence to this problem. Blockchain is undoubtedly a genie that’s been let out of the bottle. It’s never going back in again. But it needs to be done correctly, and for the benefit of all of us.